In the rapidly evolving landscape of artificial intelligence and technology, IronArc Ventures has established itself as a leading force in growth capital investing. We specialize in AI-focused companies with strong risk-return potential. Our approach is deliberate and concentrated – we make bold commitments to ventures we believe will define the next generation of technology leaders.

As a full stack capital partner, we provide flexible funding for Series B onward. We adapt our approach to support portfolio companies at each growth stage. Our ability to invest across multiple stages makes us a reliable, long-term partner for ambitious companies on their journey to market leadership.

Co-founder & General Partner

Ish Dugal has over 18 years of VC and growth capital investment experience with a focus on AI and Digital infrastructure. Before co-founding IronArc Ventures, he was the CIO of GoldenArc, a private investment firm. Ish has led investments of over $500M in companies like Anthropic, Scale AI, xAI, Groq, DigitalOcean (DOCN), Rubrik (RBRK), Robinhood (HOOD), Netskope, and Marqeta (MQ). He has invested in 30+ companies and contributed to six IPOs. His track record includes top-decile or top-quartile IRR, TVPI, and DPI performance. Previously, he was Sr. Investment Director at RN Group, a $10B tech focused fund. Earlier, he was an Associate at Paladin Capital Group, a PE and VC firm with over $2B in assets. Ish has served on the boards of several public and private companies. Ish holds an MBA from The Wharton School and a B.S. with High Honors from the University of Maryland, College Park.

Co-founder & General Partner

Patrick Flynn is an accomplished investment professional with over 12 years of experience in private and public markets. He is the Founder and Co-General Partner at IronArc Ventures, focusing on AI-centric technologies. Previously, Patrick was Managing Partner at Iron Pine Ventures, Partner at Accuidity, and Managing Director of Venture Capital at a leading multi-family office, where he raised and deployed over $350 million annually. Since 2014, he has raised and deployed over $5 billion across public and private markets, specializing in late-stage venture investments. His portfolio includes investments in SpaceX, Stripe, Palantir, Anthropic, Marqeta, Anduril Industries, Plaid, and Databricks, with successful IPOs and outstanding returns from companies like Zoom (ZM), Ginkgo Bioworks (DNA), and Coinbase (COIN). Additionally, he has invested in Flexport, Addepar, Netskope, Discord, Rubrik, Figma, Chime, and more, showcasing his broad influence in the industry. Patrick holds a Bachelor of Arts from Dartmouth College, where he was a two-time captain of the Varsity Lacrosse team and a member of the Varsity Rugby team.

Partner

VP of Finance, CCO

VP of Operations

Senior Associate

Senior Associate

Senior Associate

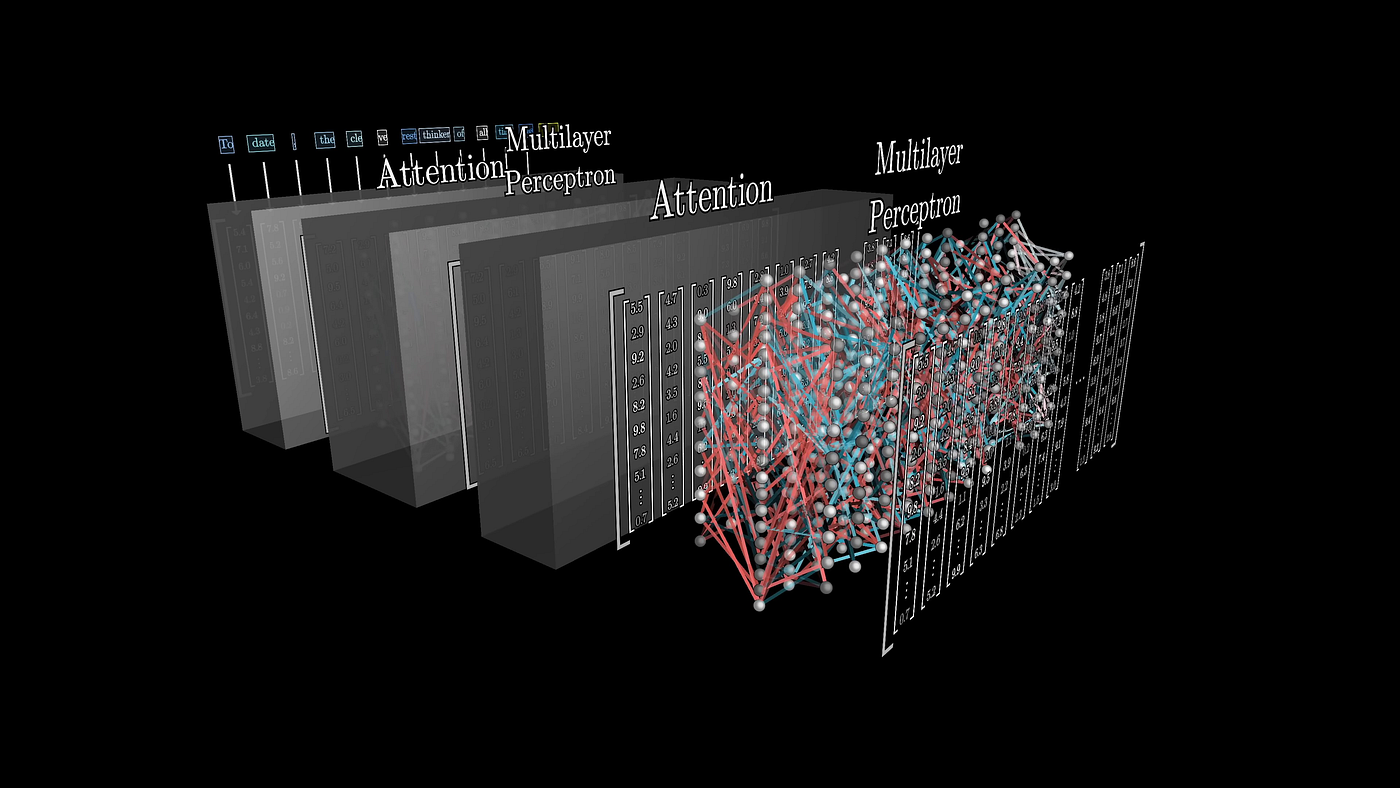

A fundamental constraint is emerging in AI today. While companies race to build larger models and buy more GPUs, the real bottleneck has become something far more mundane: quality training data. Three critical takeaways reshape how investors must evaluate AI companies: Mathematical constraints create an inevitable data ceiling. The 20-to-1 rule reveals that optimal AI […]

How frontier model companies are mining for non-human intelligence. The modern AI revolution represents a rare technological nexus where three critical streams — data abundance, computing power, and algorithmic innovation — have converged with extraordinary force. Like the California Gold Rush of 1849, this convergence has triggered a frantic scramble for advantage, with eye-watering sums […]

As artificial intelligence reshapes the global economy, a fierce competition for computational supremacy is unfolding across America. The nation’s electricity grid may prove the ultimate bottleneck. In the plains of Louisiana, a data center of unprecedented scale is taking shape. When complete in 2030, Meta’s newest facility will consume over 2 gigawatts of electricity—roughly equivalent […]

The companies shown on this page do not represent all investments made by funds managed by IronArc Ventures LLC or by prior related entities advised by IronArc Ventures LLC or its members (collectively, “IronArc”). It should not be assumed that any or all of these investments were, or will be, profitable. Past performance of funds managed by IronArc is not necessarily indicative of future results. IronArc generally updates this list quarterly and does not guarantee that recent investments or dispositions are included.

© 2026 IronArc Ventures. All rights reserved | Privacy Policy | Business Continuity Plan | Form ADV